Car insurance isn’t the kind of expense you simply shrug off, especially if you pay it annually, or every two years. So when times get tough, it’s often one of the first expenses you start to eyeball, and wonder if you really need it. I mean, you haven’t been in an accident in five years, and the last one was a minor bump anyway, right?

Unfortunately, in most states, you don’t really have much of an option. While some states technically don’t require drivers to have auto insurance, drivers in those states are financially responsible for minimum liability amounts if they are at-fault in an accident, and can be subject to fines and suspension of driving privileges for failure to meet that responsibility. In addition, drivers must register with the state to declare their ability to meet financial responsibility for auto accidents. So even in states where auto insurance is not mandatory, the reality is that most of us need to have it anyway.

Specific auto insurance requirements vary from one state to another, but as a general rule you are required to have at least enough cover to pay for the damage done by you if you cause an accident. Most people choose to have a greater level of coverage, including Uninsured Motorist Insurance (UMI), which covers you if you are hit by an uninsured driver.

Mandatory Coverage Levels by State

Below is a table listing the minimum liability levels by state. Cover levels are normally expressed as three numbers, for example 25/50/10 – these are explained in more detail in the article on minimum liability levels.

[table id= 6]

So Why Do We Need It?

The simple reason is because in the end, it works out best for everyone. Requiring insurance means that most people have the coverage required to pay for any damage they cause, and the penalties for not complying help to cover the rest – Virginia fines you $500 if it catches you without insurance, and makes you get insurance, and then puts that money into a fund to cover damage done by selfish people like yourself who went and crashed without insurance.

In order to make sure that the auto insurance system works out as best as it can for as many people, it usually comes down to a system where some kind of cover is mandatory. If it is mandatory, and everyone pays insurance, the amount of insurance paid by everybody is as low as possible. As soon as there are accidents that are not covered, and insurance buyers have to pick up the slack created by those who dodge the system, those people inevitably end up paying more.

The penalty for not having it is severe, but there is only a slim chance it will affect you. However, the net effect of many people not paying insurance is that there is less money floating around in the insurance system, and so insurers have to charge more for their services to cover the claims they get.

Looking at it from the Insurer’s Point of View

Insurers care about two numbers: how much money they get in, and how much they have to pay out. If the first number is less than the second number, they either have to increase prices, get more customers, or go bust. Since growing your customer base takes time and money, the quickest way is to up prices – but the state won’t always let them do this.

We end up with a system that doesn’t really help either the insurance companies or the insurance buyers. Mike the Actuary, a popular insurance and risk columnist, made this important comment on the current system of mandatory insurance:

“Most states mandate coverage, penalize those without insurance, and then lean on insurers to keep the rates low. This causes all sorts of pressure to refrain from rating based on risk and, in general, turns the automobile insurance system into a socialized risk program.”

Unfortunately there isn’t any hard data on the total cost of America’s uninsured drivers – the next study comes out in 2012. What we do know is that, to explain Mike’s comment above, insurers are unable to properly insure you based on your individual risk as a driver, because they have to take into account all the people they don’t know about who are not insured.

What Are The Odds?

In the insurance game, “getting caught” can mean two things, both of which have stiff penalties, and one of which might not be your fault. The first is obviously being caught without insurance.

This is your fault, of course. However, the odds are remarkably low. A 2009 study found that as many as one in seven drivers are uninsured. That’s across all states. The top ten worst states are:

1. Mississippi (28%)

2. New Mexico (26%)

3. Tennessee (24%)

4. Oklahoma (24%)

5. Florida (24%)

6. Alabama (22%)

7. Michigan (19%)

8. Kentucky (18%)

9. Rhode Island ( 18%)

10. Indiana (16%)

Shame on you. This means the odds of catching an uninsured driver are good, if you’re a cop. Pull ten cars over in a day and you’ll probably find one. Fortunately, most states have laws that prevent cops from doing this sort of thing. But some states, and countries like Great Britain, have recently implemented laws that create large databases that the police can use to sniff out uninsured people.

The other type of being caught is being hit by an uninsured driver, or having an accident when uninsured. As we just mentioned, the odds of that happening are one in seven, or over one in four in Mississippi. This is where you’ll be glad if you live in Virginia, where there is a fund to cover this sort of thing. If you live in a state without such a fund, or you simply don’t qualify, you are out of luck – you have to either pay the bills yourself, or take the at-fault party to court. In the event that you do take them to court, you will almost certainly spend months of your life in litigation, and spend about as much as you get out of them – and you will bankrupt somebody who is already probably poor.

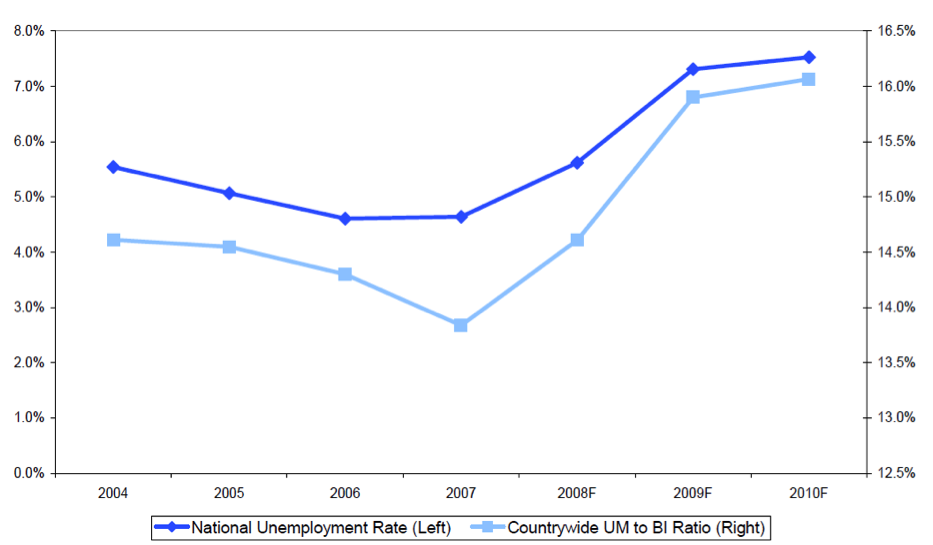

As the economy takes a dive, these odds are only going to get worse for you. This is a slightly old study now, but it shows how the UM to BI ratio (uninsured motorist claims to bodily injury claims) increases as unemployment increases:

It Gets Worse

In a slightly bizarre study that possibly mistakes correlation for causation and invokes Murphy’s Law at the same time, it turns out that uninsured drivers are more likely to cause an accident. Quoting from the extract:

“In the year 2007, Ohio had 328,742 car crashes. 15,155 of those same car crashes involved uninsured drivers, and in 11,488 of those 15,155 car crashes the uninsured Ohio car drivers were at fault. That [represents] 75% [of all crashes].

That means that if you lived in Ohio and were insured in 2007, and you had a car accident, there was a 3 in 4 chance that you had to cover the costs of your own repairs. That makes comprehensive insurance start to look a lot more attractive.