South Carolina Auto Insurance Requirements

South Carolina Auto Insurance Requirements

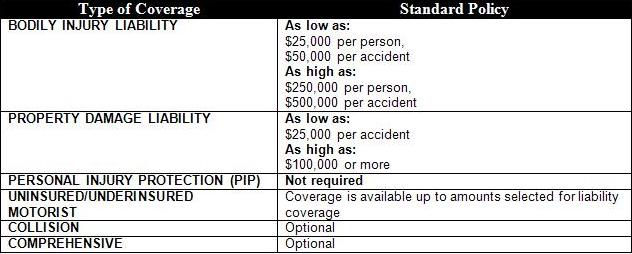

Drivers are not legally required to obtain auto insurance, and may drive uninsured, but must pay a $550 annual fee to the South Carolina Department of Public Safety to drive without insurance. This is not recommended for any driver who has significant assets or financial responsibilities. The South Carolina Department of Insurance requires that motorists have the following minimum coverage on every vehicle:

(Source: South Carolina Department of Public Safety)

(Source: South Carolina Department of Public Safety)

Drivers who do not carry a valid state insurance card (or are uninsured and have not paid the uninsured driver fee) face civil fines of up to $550 and suspension of driver’s license.

Factors Influencing Car Insurance Premiums in South Carolina

Finding cheap car insurance in South Carolina is easier than in most states, as South Carolina ranks as among the cheapest states in the U.S. in which to insure a motor vehicle. There are a variety of factors that go into underwriting auto insurance, and South Carolina is subject to some of the better conditions for drivers to get cheap car insurance:

– Population density, which is directly related to the number of cars on the road, and accident rate. South Carolina is primarily a rural state, with concentrated population centers.

– PIP coverage is not required in South Carolina.

– Theft and vandalism rates are below national averages.

– Auto insurance fraud cases are below national averages.

The average auto insurance premium for residents in South Carolina is $1,095 in 2011; the national average is $1,790. South Carolina ranks as the least expensive state in which to insure a car.

Tips for Obtaining Cheap Car Insurance in South Carolina

– Multi-car discounts

– Bind multiple policies (homeowners, life, auto) with the same provider

– Maintain a good credit score

– Create a personal “emergency fund” of up to $1500 and increase your deductibles

– Get at least three quotes at renewal time

– Talk to your insurance provider about affinity discounts

– Drop comprehensive and collision insurance on older vehicles

South Carolina Statistics

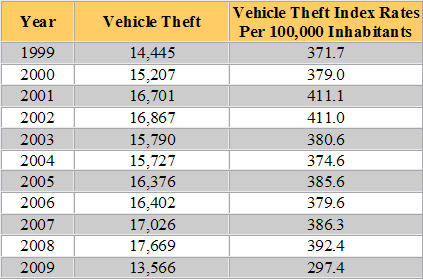

– Auto Theft: South Carolina has one of the highest auto theft rates in the nation, and this rate has remained fairly steady in the past 10 years. However, the theft rate decreased significantly in 2009. This can be attributed primarily to anti-theft devices being standard on recent model cars, as well as public awareness of the issue:

(Source: Auto Thiefs)

(Source: Auto Thiefs)

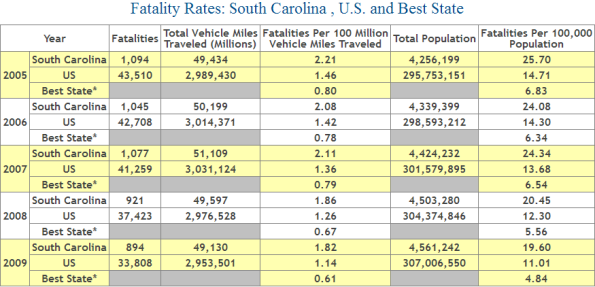

– Automobile Accidents: While the number of fatal accidents in South Carolina has been decreasing consistently over the past few years, South Carolina still has one of the highest auto fatality rates in the nation. Total vehicle miles traveling in South Carolina have remained fairly constant over the same period.

(Source: National Highway Transportation Safety Administration)

(Source: National Highway Transportation Safety Administration)

Enter your Zip Code below to find Cheap Car Insurance in South Carolina.