It’s no big secret that the economic downturn of the past few years has caused many families to take a look at their household budget, and make hard decisions on expenses that can be eliminated, costs that can be reduced, and essential items that need to be maintained. Car insurance coverage is one area that more and more consumers are deciding to either downgrade or eliminate altogether in order to reign in expenses.

It’s no big secret that the economic downturn of the past few years has caused many families to take a look at their household budget, and make hard decisions on expenses that can be eliminated, costs that can be reduced, and essential items that need to be maintained. Car insurance coverage is one area that more and more consumers are deciding to either downgrade or eliminate altogether in order to reign in expenses.

A recent survey by the National Association of Insurance Commissioners revealed some troubling statistics with respect to car insurance. Nearly 20% of the survey respondents report having reduced or entirely cancelled their car insurance in the past 12 months in order to better manage their personal expenses.

Nationally, the number of uninsured motorists has been increasing steadily for the past several years. According to an Insurance Research Council report, one in seven drivers are uninsured, and the rate is nearly one in five in the top 10 states.

States Respond

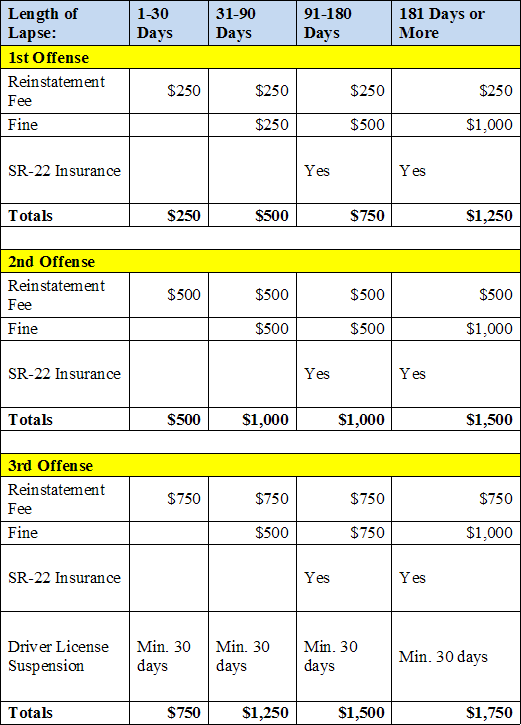

States are responding to the uninsured motorist crisis in various ways, using both the carrot and stick approaches. California has recently enacted legislation that provides minimal insurance coverage for economically disadvantaged motorists. The theory is that if car insurance rates are put within the reach of everyone, drivers will maintain car insurance. On the other hand, Nevada enacted legislation this year that significantly increases the penalties for allowing auto insurance to lapse. The new law went into effect on July 1, 2011:

NEVADA DMV UNINSURED MOTORIST PENALTIES

Check Your State

Other states are taking similar approaches, but most of these legislative actions are focusing on drivers, rather than addressing the underlying causes of high car insurance rates.

On carinsurancelist.com, we’ve compiled the information that you need in order to make both informed purchasing decisions with respect to car insurance coverage. The state pages also describe penalties for driving uninsured, as well as other factors that generically influence car insurance premiums in your state.

Risky Business

The bottom line is that driving without car insurance is a highly risky proposition. Not only are you placing yourself (and your family) at greater financial risk, but getting car insurance after a lapse in coverage could be even more expensive and out of reach. Almost all car insurance companies will rate you as a much higher risk, and therefore charge you more if there has been a lapse in coverage, regardless of the reason – and that’s not even taking into consideration the state penalties that might be enforced.

Dropping your car insurance in order to manage your money in tough economic times may seem like an acceptable short term solution, but you need to take a hard look at the long term implications prior to making such a risky decision. Use every strategy possible to reduce your rates, rather than drop coverage altogether.