If it’s your first time applying for car insurance, there is a good chance that you will not end up getting the best deal that you could get. This is simply because insurance companies have a great deal of experience in getting people to buy more than they want or need. The only way that you can make sure that you get a good deal is by knowing as much as you can before you go into the process.

Insurance companies will take the information that you provide in an insurance quote request form and they will present you with options. However, they don’t provide a lot of objective information about whether you need all of those things, or if you could do just as well with less. Insurance companies are also very good at “upselling”, which is simply a Marketing term for convincing you to go for the seafood platter when you only came in for a burger.

Before you start filling out every application form you can find, here are a few things you should know before you start:

1) Fully Comprehensive or Third Party Cover?

This is the most important decision you will need to make when purchasing car insurance. The difference is simple:

Fully Comprehensive – covers you against all damages done by yourself, theft and damage done by uninsured drivers

Third Party – covers damages done by you to another driver’s vehicle, and sometimes fire and theft (depending on your state and the level of cover).

Obviously, fully comprehensive insurance will be much more expensive than third party insurance, but you can see why the extra money can be worth it. Third party cover is the least expensive, and is generally a minimum requirement for purchasing or driving a car on the road in any state.

The other drawback of third party only cover is that you will not be able to claim if you are hit by an uninsured driver. In this case you will have to pay the costs of your repairs yourself, or take the other driver to court.

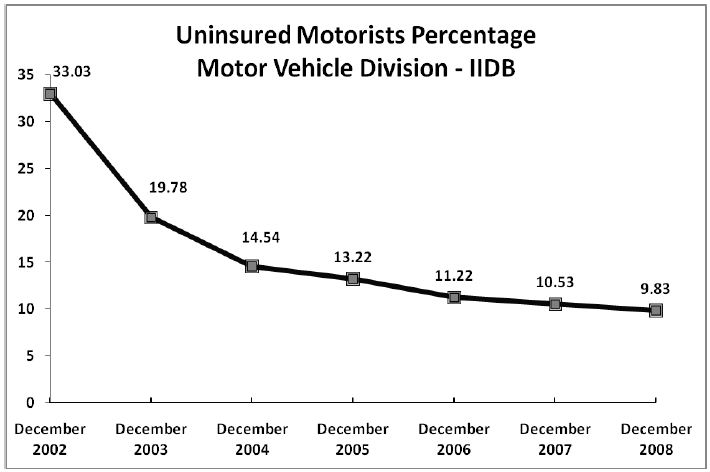

Fortunately, as you can see from this graphic below, the number of uninsured drivers is decreasing every year, and this is becoming less of a risk. However, there is still close to a 1 in 9 chance that you will be hit by an uninsured driver.

2) The Deductible

The deductible is simply the part of any claim that your insurer will not pay. It is a feature of all insurance policies, and it protects the insurance company against many frivolous small claims that cost more to process than they are worth.

Unfortunately for you, it means that every time you have an accident, you will be a little out of pocket. Here’s an example:

You take out fully comprehensive insurance, and set your deductible at $500. You then have an accident, the repairs for which cost $1,000. You will have to pay the deductible of $500, and your insurance company will pay the remainder.

A few months later you mount the curb and incur $250 worth of damages. Because your deductible is $500, you will be liable to pay the entire amount for the repairs.

Having a lower deductible means that your insurance premiums will be higher. However, making your deductible too high can place serious financial strain on you if you do have an accident, and can make your insurance not worth the premiums you pay every month.

3) Your Budget

It’s important to know how much you can afford to spend on insurance before you start applying for quotes.

One very important thing to remember is that some insurance companies require you to pay six months’ or a year’s worth of premiums up front, yearly. This can be a bit of a financial strain, but it generally saves you money over paying every month for insurance.

You can even get a loan to pay off your insurance, if the cost of interest is less than the cost of the extra premiums you will be paying if you pay monthly.

Filling Out the Application:

When you fill out an application form, you will usually have to provide a great deal of personal information. This is so that your application meets as many insurance companies’ requirements as possible, and you can get as many good insurance quotes that you can.

Some of the things you will be asked include:

- Your age – if you are under 25, you will usually have to pay higher premiums. This is seen as drastically unfair by everybody under 25, but statistics show that younger drivers have more accidents. However, some insurance companies will offer you the over-25 rate if you agree to complete additional driving courses, so look out for this.

- Where you live – Some areas are a higher threat risk, and some areas require a commute over dangerous roads. Insurance companies take all of these factors into account when compiling your quote.

- Any other drivers – Beware: adding more drivers to your insurance policy can be very expensive. If you want your child to start learning in your car, it can be pricey but necessary. If your girlfriend wants to be able to drive your car sometimes, then it usually doesn’t pay to insure her as well. However, if she is not insured, she is not covered if she has an accident.

- Your job, and where you work – Some occupations attract higher premiums, and all companies use different criteria for this, so check out other quotes if one seems unusually high. Your work address is also used to work out the risk you expose yourself to on your daily commute – when people are most likely to have small accidents.

Finishing Your Application

Once you’ve made sure all of your information is accurate, and that you have unchecked any boxes that subscribe you to annoying mailing lists, finish your application form. You should receive a number of quotes. It is important to compare each of them, and then investigate each company fully to see if they aren’t running any extra specials on their website.