There is no such thing as the ‘best’ insurance, because everybody’s needs, budgets and cars are different. Some people know that they are a little bit accident prone, and others simply like to live dangerously. Maybe you want a nice expensive car because you’ve just gotten a new job, or maybe you’ve recently changed to a lower paying job and want to cut down on your premiums.

The point is, everybody’s needs are different when it comes to insurance, and you need to understand what yours are before you go applying for a quote. The reason for this is because insurance sales tactics are some of the most well-developed in the world, and insurers are very good at convincing people that they need more products than they actually do.

It’s All About Risk

Insurance is all about risk management. Specifically, you are paying somebody to take on the financial risk you expose yourself to by owning and driving a vehicle. A major part of this risk is the risk that any damage you cause will result in a damages claim from injured parties.

When you apply for insurance, you’re like an outlaw about to have a showdown with the town sheriff (or you can be the sheriff, if you like). You’re both trying to make the other guy blink first, and nobody wants to look weak to the other person, or to the meekly-gathering townsfolk.

What you don’t want them to know is that you’re probably going to drive too fast or scrape the curb in your first week of vehicle ownership, and that your girlfriend will borrow your car for trips to the store. What they don’t want you to know is that some of the criteria they use for deciding on your risk profile might be considered ‘unfair’ – your age, your job, where you live and even your gender.

You should always know exactly what is covered by your insurance policy, or you could be in for a nasty surprise.

The Two Major Types of Auto Insurance

The first major decision you will be faced with is whether to take on fully comprehensive insurance or third party only insurance. When looking at the prices of comprehensive insurance, the decision becomes difficult.

Comprehensive Insurance – This type of insurance covers most bad things that can happen to your car, whether you caused an accident or you woke up in the morning and someone has scraped along the side of your new car with a bunch of keys. It can be very expensive, but is generally the best policy you can get.

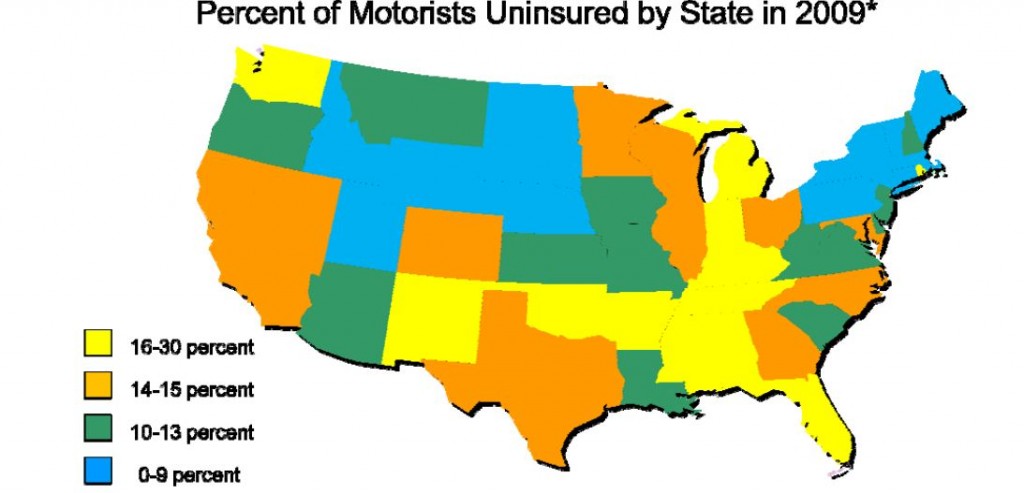

Bear in mind there will still be a deductible, so it’s not an accident-proof shield for your bank account. However, this type of insurance also covers you if hit by an uninsured driver.

Third Party (and Fire) Insurance – This is the minimum level of cover required in most states, and you will usually not be able to secure vehicle finance without a letter from your insurance company saying that you have at least some basic level of cover.

What this level of insurance cover means is that you will be able to pay insurance claims for damages caused by you, and sometimes if your vehicle catches fire (as they do from time to time).

To give you a good idea of your chance of being hit by an uninsured driver (and therefore regretting taking third party only cover), this map should tell you your risk:

Image credit: http://www.ircweb.org/News/IRCUM2011_042111.pdf

So how do you decide?

Simply put – if the value of your car is less than a year and a half’s fully-comprehensive insurance, it probably isn’t worth getting more than third-party insurance on it.

The Bells and Whistles

Insurance companies on the whole offer you better value for money than they did 20 years ago, but the policies can actually be more difficult to understand. This is because policies have been ‘fragmented’ allowing people to pick and choose different types of cover, and add special bonuses and discounts. This makes the entire process more time-consuming, but it can help you to get a better deal.

Remember to always give each ‘extra’ a critical eye and decide whether or not you need it. Roadside assistance? Your bank might have it bundled in with your account. Compare offerings from several different companies, and always check the company website to see if they are running a special that is not shown on your quote!

A good guideline is always to look at the value of your vehicle, and what it’s going to cost you if you crash it, compared to the price of 18 months’ worth of insurance.

Considering Pay-As-You-Drive?

If you are the proverbial little old lady who only uses her car once a week to go to church (or you are a student who lives on campus), pay-as-you-drive insurance might be the best way for you to save money.

These types of policies let you pay into a ‘prepaid’ account, which covers you for a certain number of miles. If you drive more than that, you simply pay more. This type of insurance is ideal for people who don’t drive often, or for only very short distances each day.