Arizona Auto Insurance Requirements

Reviewed by Dr. Christine Berry

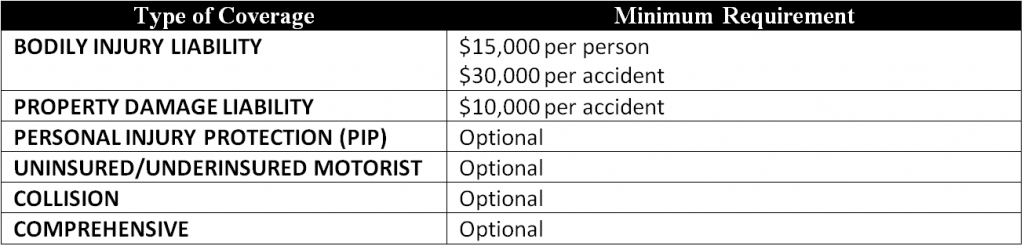

Every driver in Arizona is legally required to be covered by a current auto insurance policy or alternative proof of financial responsibility. Statute Motorists are required to demonstrate financial responsibility prior to registering a vehicle. The following minimum coverage is required on every vehicle, except as noted below:

(Source: Arizona Department of Insurance)

While most drivers choose to meet the financial responsibility requirement by providing certificates of insurance, drivers can also meet the requirements by providing proof of certificates of deposit or cash with the state treasurer. Driving without proof of financial responsibility in Arizona will result in a license plate and driver’s license suspension for three months and a $500 fine for the first offense; penalties increase significantly (up to $1,000) for subsequent offenses within 36 months.

The Arizona Automobile Insurance Plan is available to drivers who are unable to obtain such coverage through the voluntary market. More information is available on the AIPSO website.

Factors Influencing Car Insurance Premiums in Arizona

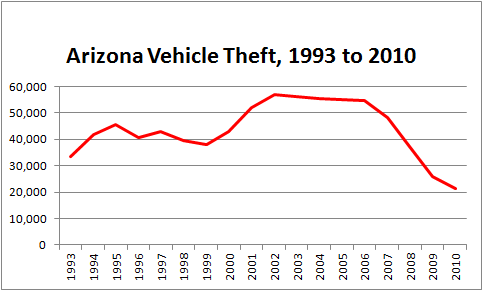

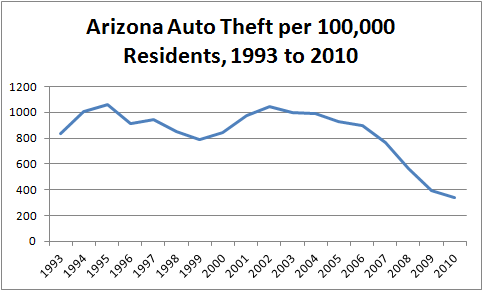

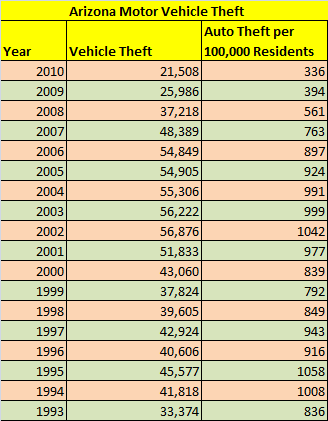

According to a report published by the National Association of Insurance Commissioners, the current average cost of auto insurance in Arizona is $837, making Arizona one of the top 15 most expensive states for insured drivers. While many factors go into underwriting auto insurance, Arizona insurance laws give good drivers the opportunity to qualify for cheap car insurance in comparison to other states. Another factor in favor of lower auto insurance premium is Arizona’s plummeting motor vehicle theft rate, which has dropped more than 50% in the past five years. However, because so many other factors play in to insurance costs, Arizona’s lower auto theft rates are not likely to have a significant impact on average insurance premiums in the short term.

Tips for Obtaining Cheap Car Insurance in Arizona

- If you’re over 55, consider taking an approved defensive driving course

- Ask about discounts for anti-theft or vehicle safety device

- Compare premium financing charges

- Check for additional fees and compare one company/agency to another

Other Things To Watch out for When Buying Car Insurance in Arizona

Consider the insurance company’s complaint ratio. Check the latest complaints and other consumer feedback at the Arizona Department of Insurance’s website, http://www.id.state.az.us.

Arizona Automobile Statistics

Auto Theft: Historically, Arizona has suffered from one of the highest rates of auto theft in the nation, but this rate has been decreasing. Recent efforts by local law enforcement, in conjunction with government agencies like the Arizona Automobile Theft Authority and the Arizona Vehicle Theft Task Force, have dramatically lowered the number of stolen cars in Arizona. Arizona’s anti-theft programs have focused on increased awareness of theft, as well as aggressive police efforts. Fewer incidences of car theft should lead to far lower insurance premiums for all Arizona drivers.

(Source: Arizona Automobile Theft Authority Annual Reports )

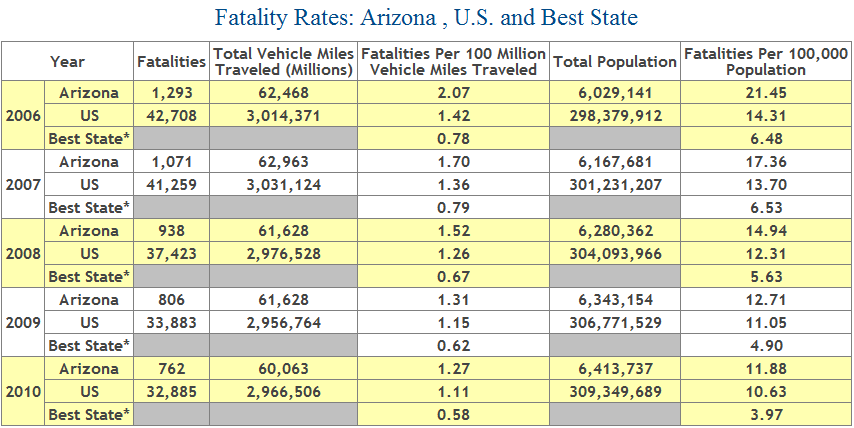

– Automobile Accidents: Although total vehicle miles traveled have remained fairly constant over the past five years, the number of fatalities on Arizona roads has decreased nearly every year. 2009 and 2010 saw substantial decreases in the number of deaths in car crashes:

(Source: National Highway Traffic Safety Administration)

Enter your Zip Code below to find Cheap Car Insurance in Arizona.