Arkansas Auto Insurance Requirements

Arkansas Auto Insurance Requirements

Reviewed by Dr. Christine Berry

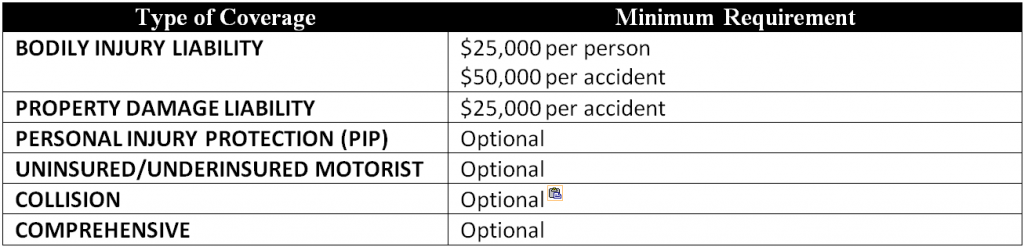

Arkansas drivers are legally required to be covered by a current auto insurance policy. Minimum coverage requirements in Arkansas are somewhat higher than other states, partially due to adverse driving statistics in the state as well as weather-related claims. The Arkansas Insurance Department requires that motorists have the following minimum coverage on every vehicle:

(Source: Arkansas Insurance Department)

The Arkansas Automobile Insurance Plan was created in 1947 to provide automobile insurance coverage to drivers who seek car insurance coverage but are unable to obtain it through the voluntary market. For more information about this program, call (800)413-5808.

Drivers who do not carry a valid Arkansas insurance card face civil fines of between $50 and $250 for a first offense, suspension of driving privileges, and loss of car registration / tags. Proof of coverage must be provided prior to reinstatement.

Factors Influencing Car Insurance Premiums in Arkansas

Finding cheap car insurance in Arkansas takes some work, because the state ranks in the top 20% when it comes to average car insurance costs. While there are a variety of factors that go into underwriting auto insurance, Arkansas insurance laws give good drivers the opportunity to qualify for cheap car insurance with a good driving record, and depending on where you live (rural -vs- urban). The average auto insurance premium for residents in Arkansas is about $650, which is the 32nd-highest average cost among the 50 states and the District of Columbia.

Tips for Obtaining Cheap Car Insurance in Arkansas

– Arkansas insurers are required by law to provide college graduate and defensive driving discounts for seniors 55 and over who have completed an approved defensive driving course.

– Buy multiple insurance products (homeowners, life, auto) from the same insurer.

– Maintain a good credit score

– Create a personal “emergency fund” of up to $1500 and increase deductibles accordingly

– Discuss affinity discounts with your insurance provider

– Drop comprehensive and collision insurance on older vehicles

Arkansas Statistics

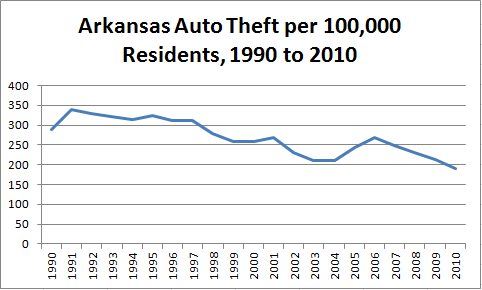

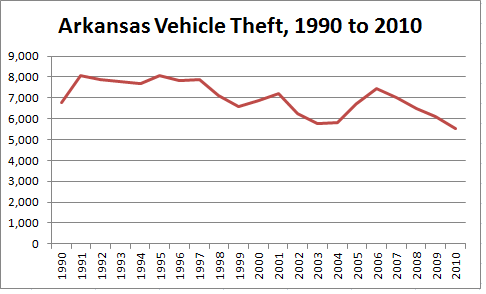

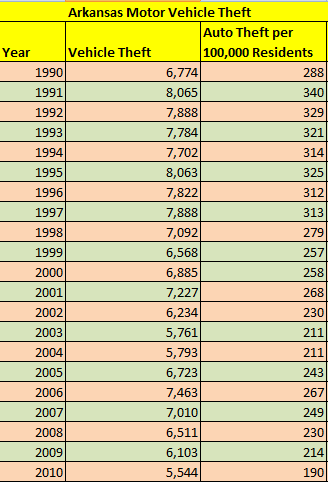

– Auto Theft: Comparatively speaking, Arkansas enjoys one of the lower rates of auto theft in the nation, and the theft index rate has remained fairly consistent over the past 10 years:

(Sources: Arkansas Crime Information Center, U.S. Census Bureau, and FBI Uniform Crime Reports)

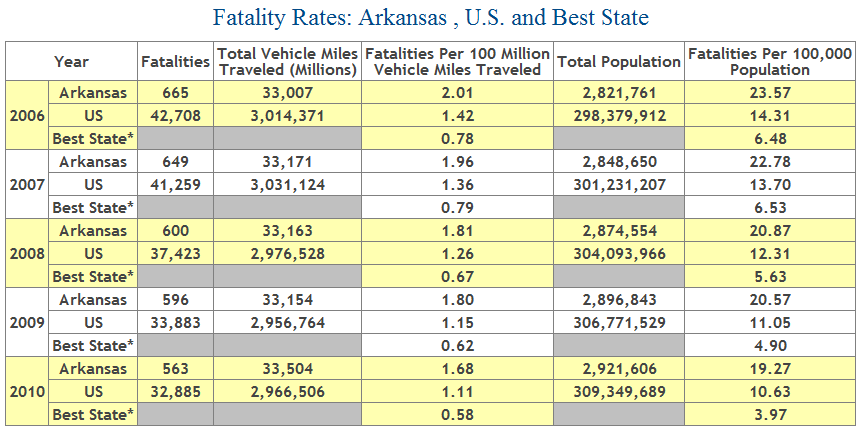

– Automobile Accidents: As can be seen in the chart below, Arkansas has a high incidence of auto fatalities compared to other states:

(Source: National Highway Traffic Safety Administration)

Enter your Zip Code below to find Cheap Car Insurance in Arkansas.