California Auto Insurance Requirements

California Auto Insurance Requirements

Reviewed by Dr. Christine Berry

California has a variety of options for motorists seeking cheap car insurance. While drivers in California are required to meet financial responsibility laws, both insurance policy options and alternatives for demonstrating financial responsibility exist.

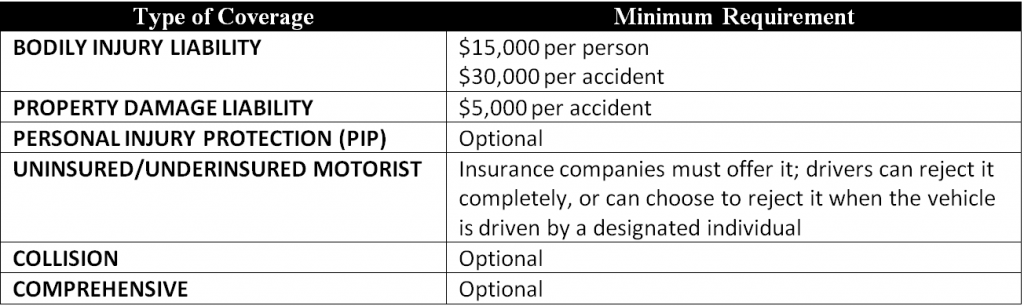

If drivers choose to purchase auto insurance to meet the financial responsibility requirements, as do most California drivers, they must meet minimum auto insurance coverage requirements that are mandated by the California Department of Insurance. The following minimum coverage is required on every registered vehicle, except as noted below:

(Source: California Department of Insurance)

Alternatively, drivers not wishing to carry basic liability insurance in California may either deposit $35,000 cash or obtain a surety bond in the amount of $35,000 with the Department of Motor Vehicles. A certificate of financial responsibility will be issued in lieu of an insurance card.

Driving without meeting the financial responsibility laws in California will result in a license plate and driver’s license suspension as well as a fine for the first offense; penalties increase significantly for subsequent offenses. Financial responsibility must be demonstrated prior to reinstatement of license and tags. It is not legal to even park a car on a public street if the vehicle is not properly insured.

The California Low Cost Automobile Insurance Plan (LCA) is available to drivers who are unable to obtain such coverage through the voluntary market. More information is available on the LCA website. In addition, the State of California offers this program to responsible drivers who meet certain income criteria, have a good driving record, but are unable to get affordable car insurance coverage.

Factors Influencing Car Insurance Premiums in California

Finding cheap car insurance in California takes some legwork and research. California ranks in the top 20 most expensive states for car insurance costs. While many factors go into underwriting auto insurance, California insurance consumers are faced with conditions that negatively impact car insurance quotes and rates:

- Severe urban congestion, which means more cars on the roads and highways

- Vehicle repair costs are generally more expensive in California than elsewhere

- Overall accident rates are higher than national averages

- A relatively high percentage of uninsured drivers, estimated at 14%-15% by the Insurance Research Council

- A higher rate of auto insurance fraud than other states

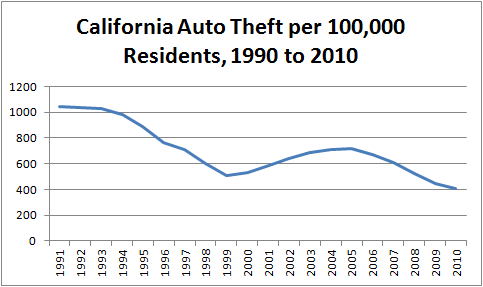

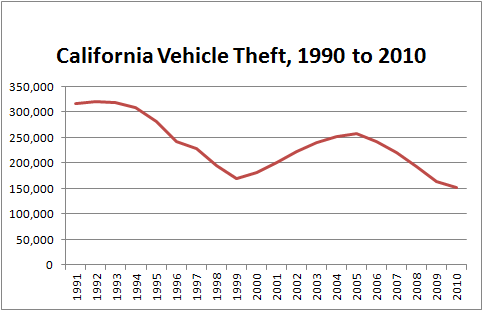

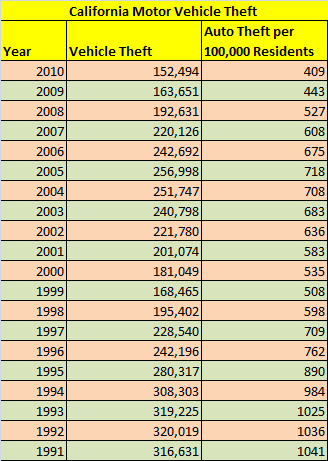

- Vehicle theft rates above national averages

The average annual auto insurance premium for residents in California is $754.

Tips for Obtaining Cheap Car Insurance in California

- See if you’re eligible for the California LCA Plan

- If you’re over 55, consider taking an approved defensive driving course (discounts might be 15%)

- Ask your insurance agent about discounts for college graduates and good students

- Combine multiple insurance policies (homeowners, life, auto) with the same provider

- Instead of paying a high premium in exchange for a low deductible, save $1,000-$2,000 for automobile repairs and increase your deductible.

- Ask if any discounts are available based on where you work, where you go to school, or the organizations you belong to.

- If your car is worth less than $1,000 and there are no leinholders on the title, don’t waste money on comprehensive or collision insurance – it’s just not worth it.

- A little good news for Californians: while it’s still important to worry about your credit rating, the state of California has banned insurers from factoring a driver’s credit score into his or her insurance costs.

California Statistics

– Auto Theft: California has one of the highest rates of auto theft in the nation, but this rate has been decreasing (as is the case in most states) consistently over the past 10 years. This can be attributed primarily to anti-theft devices being standard on recent model cars, as well as public awareness of the issue:

(Source: State of California Department of Justice)

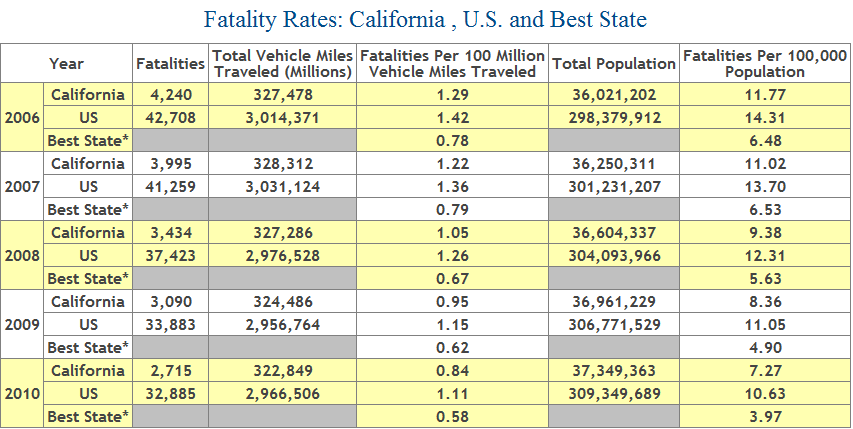

– Automobile Accidents: The total vehicle miles traveled in California have declined in recent years, and following a nationwide trend, so have accident fatality rates. Though there has been a substantial decrease in California in the number of deaths from car crashes, California still has over 8%of the national total of vehicle fatalities.

(Source: National Highway Traffic Safety Administration)

Enter your Zip Code below to find Cheap Car Insurance in California.