Colorado Auto Insurance Requirements

Colorado Auto Insurance Requirements

Reviewed by Dr. Christine Berry

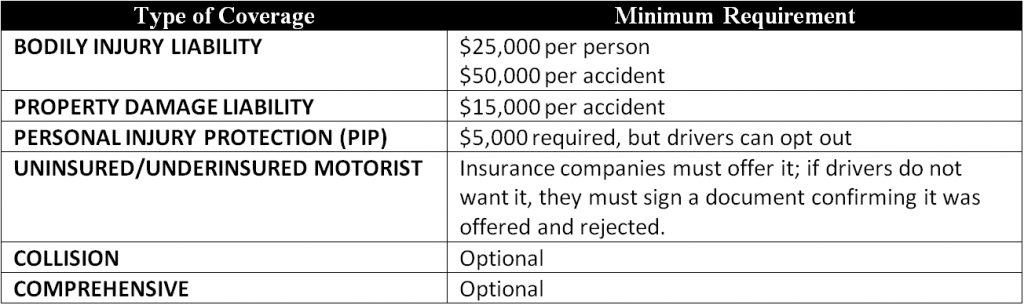

Every driver in Colorado is legally required to be covered by a current auto insurance policy. Minimum auto insurance coverage requirements are mandated by the Colorado Division of Insurance. The following minimum coverage is required on every registered vehicle, except as noted below:

(Source: Colorado Division of Insurance)

Colorado is extremely tough when it comes to driving without insurance. You could receive a $500 fine, license suspension, and 4 points on your Colorado motor vehicle record for a first offense. Penalties increase significantly for second and subsequent offenses, including high fines, insurance surcharges, and community service requirements.

The Colorado Motor Vehicle Insurance Plan is available to drivers who are unable to obtain car insurance coverage through the voluntary market. The Colorado assigned risk pool is part of the Western Association of Automobile Insurance Plans (WAAIP). More information is available by calling (800)227-4659.

Factors Influencing Car Insurance Premiums in Colorado

Finding cheap car insurance in Colorado requires research and obtaining multiple quotes, even though the state ranks in the bottom 50% of most expensive states for car insurance costs. Many conditions impact car insurance quotes and rates in Colorado, including:

– Vehicle repair costs are generally more expensive in Colorado than elsewhere

– Overall accident rates are higher than national averages

– A higher percentage of uninsured drivers

– Auto insurance fraud

– Vehicle theft rates above national averages.

The average auto insurance premium for Colorado drivers is $741 per year, which makes it the 20th most-expensive state for car insurance.

Tips for Obtaining Cheap Car Insurance in Colorado

- If you’re over 55, consider taking an approved defensive driving course

- Ask about “pay as you drive” car insurance if you are a low mileage driver – some insurers offer this in Colorado

- Ask about discounts for anti-theft devices and airbags

- Comparison shop – Colorado has a “vibrant” insurance market with many auto insurers competing for your business

Remember These Other Ways of Saving on Car Insurance

- Practice responsible defensive driving. A good driving record is the best thing you can do to lower your car insurance premium.

- If you are a college student or recent graduate, ask your insurance company about discounts for grads or good students.

- Combine all of your insurance policies (home, life, and all automobiles) with a single insurance company. Ask for the bundled rate when you compare insurance companies, before you choose an insurer

- Maintain a good credit score. In Colorado, credit scores can and do influence your car insurance premium.

- Instead of relying on a high deductible, work toward saving $1,000-$1,500 for automotive emergencies. Once you have this amount saved up, increase your car insurance deductible accordingly and enjoy a lower premium.

- If your car(s) are completely paid off and worth less than $1,000, don’t pay for collision or comprehensive insurance.

- Talk to your insurer about discounts based on where you work, where you went to school, or the organizations you belong to. Most leading insurance companies have at least a few “affinity discount” programs in place with large employers, universities, and membership organizations.

Colorado Statistics

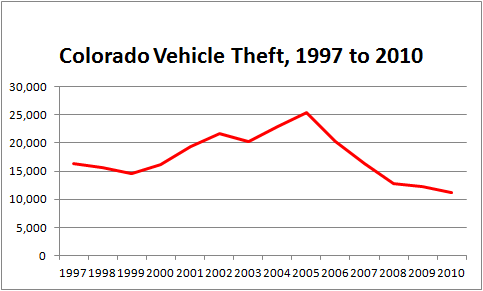

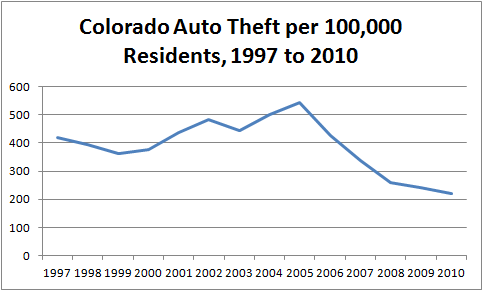

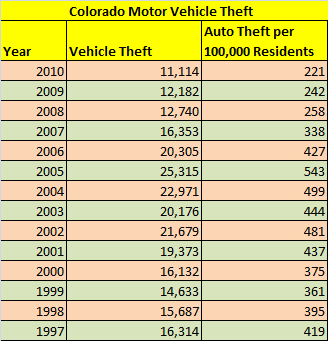

– Auto Theft: Colorado incidences of auto theft have decreased dramatically in recent years. This can be attributed primarily to anti-theft devices being standard on recent model cars, as well as public awareness of the issue:

(Source: Colorado Bureau of Investigation, Crime in Colorado Annual Reports; U.S. Census Bureau)

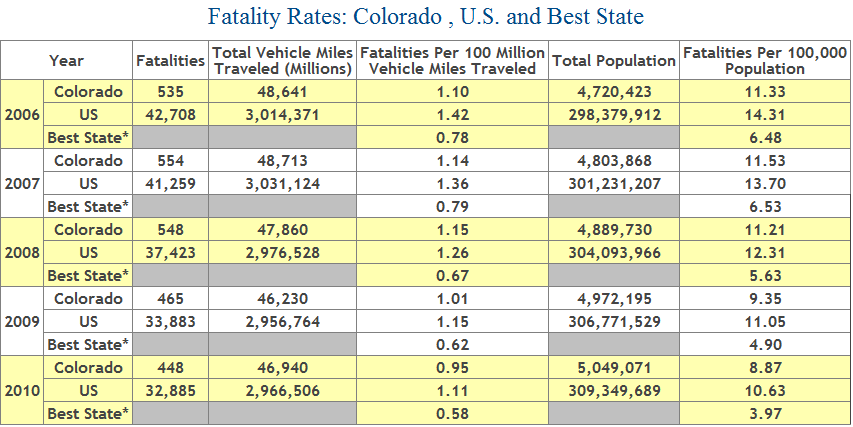

– Automobile Accidents: The total vehicle miles traveled in Colorado have remained fairly constant in recent years, following a nationwide trend, though 2009 saw a substantial decrease in the number of deaths in car crashes.

(Source: National Highway Traffic Safety Administration

Enter your Zip Code below to find Cheap Car Insurance in Colorado.