Delaware Auto Insurance Requirements

Reviewed by Dr. Christine Berry

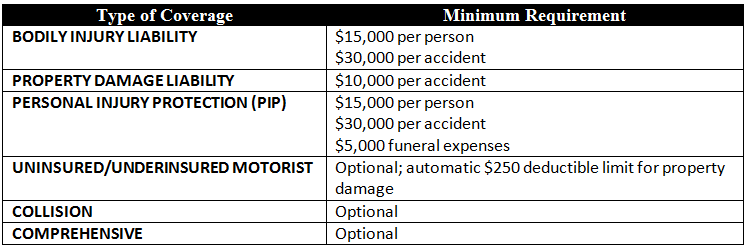

Drivers in Delaware are required to be covered by a current auto insurance policy. Minimum mandatory auto insurance coverage requirements in Delaware are set by the Delaware Department of Insurance. The following minimum coverage is required on every registered vehicle:

(Source: Delaware Department of Insurance)

Driving without the mandatory liability insurance in Delaware can result in a driver’s license suspension for six months and up to a $1,500 fine for the first offense; penalties increase to $3,000 for subsequent offenses. It is not legal to even park a car on a public street in Delaware if the vehicle is covered by the required liability insurance.

The Delaware Automobile Insurance Plan (DAIP) is available to drivers who are unable to obtain required coverage through the voluntary market. More information is available on the DIAP website.

Factors Influencing Car Insurance Premiums in Delaware

Finding cheap car insurance in Delaware takes some legwork and research, but it helps that Delaware ranks as one of the least expensive states for car insurance costs. While many factors go into underwriting auto insurance, Delaware insurance consumers enjoy market conditions that positively impact car insurance quotes and rates:

– While urban congestion is an issue in the state population center of New Castle County, the rest of Delaware is relatively rural.

– Overall accident rates are lower than national averages

– Auto insurance fraud is below the national average

– Vehicle theft rates are below national averages.

The average auto insurance premium for residents in Delaware is $1,021, which is the 5th-highest in the nation (compared to the 50 states and D.C.)

Tips for Obtaining Cheap Car Insurance in Delaware

– Defensive driving coursesapproved by the Delaware Department of Insurance provide you with an automatic 10% discount premium discount for 3 years; if retaken within 90 days prior to the end of the first three years, the discount increases to 15%; make sure all drivers of the car take the course(s) to receive the discount

– When you buy your car, opt for a less expensive vehicle; avoid luxury vehicles and sports cars

– Maintain a good driving record

– College graduates receive discounts

– Bind multiple policies (homeowners, life, auto) with the same provider

– Maintain a good credit score

– Create a personal “emergency fund” of up to $1500 and increase deductibles accordingly

– Discuss affinity discounts with your insurance provider

– Drop comprehensive and collision insurance on older vehicles

Delaware Statistics

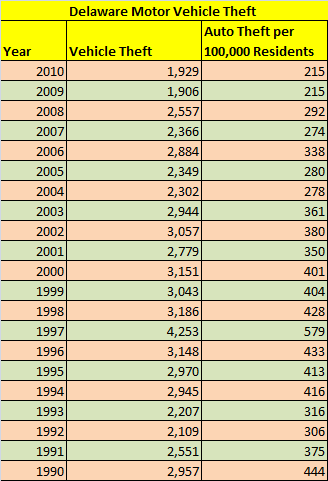

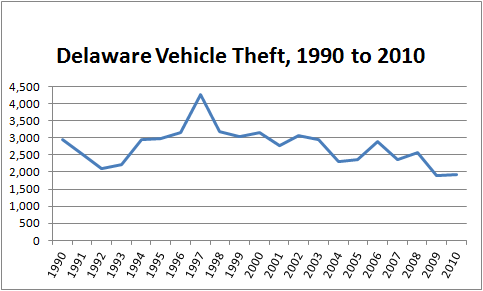

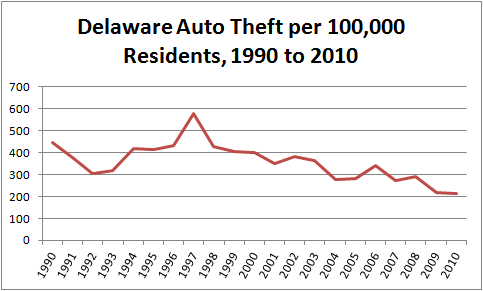

– Auto Theft: Delaware’s auto theft rate is relatively low compared to the rest of the nation, and this rate has been decreasing (as is the case in most states) consistently over the past 10 years. This can be attributed primarily to anti-theft devices being standard on recent model cars, as well as public awareness of the issue.

(Source: Delaware Statistical Analysis Center)

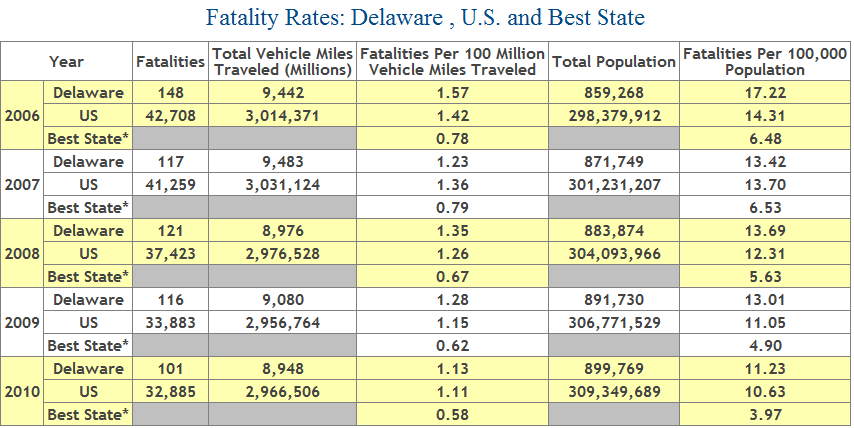

– Automobile Accidents: The total vehicle miles traveled in Delaware have declined in recent years, and following a nationwide trend, so have accident fatality rates. 2009 saw a substantial decrease in the number of deaths in Delaware car crashes.

(Source: National Highway Traffic Safety Administration)

Enter your Zip Code below to find Cheap Car Insurance in Delaware.