Iowa Auto Insurance Requirements

Iowa Auto Insurance Requirements

Reviewed by Dr. Christine Berry

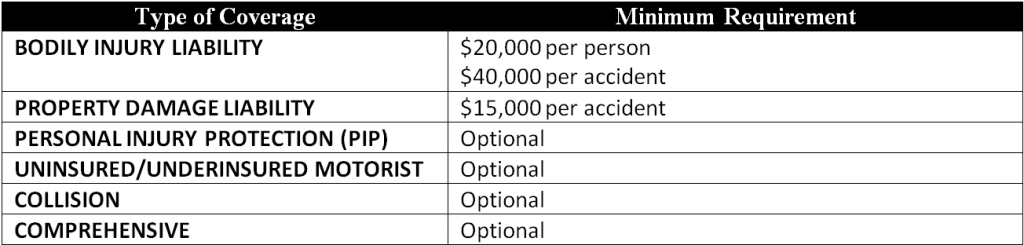

Technically, Iowa does not have a compulsory auto insurance requirement., But, it does have very strict financial responsibility laws for both private and commercial vehicle owners. Minimum auto insurance coverage requirements in Iowa in order to meet financial responsibility requirements are mandated by state law and the Iowa Department of Transportation. The following minimum coverage is required on every registered vehicle, except as noted below:

(Source: Iowa Department of Transportation)

Iowa does not have a compulsory auto insurance law, per se. Instead, the Financial and Safety Responsibility Act requires that drivers be able to show proof of financial responsibility after an accident or on demand by a law enforcement officer during a vehicle stop. The most common way to show proof is to carry auto insurance. More information is available on the Iowa Department of Transportation website.

The Iowa Automobile Insurance Plan is available to drivers who are unable to obtain required coverage through the voluntary market. More information is available on the AIPSO website.

Alternatively, drivers not wishing to carry basic liability insurance in Iowa may deposit cash or securities in the amount of $55,000 with the Office of Driver Services, or obtain a surety bond, and provide receipt of same to the Office of Driver Services, who will issue a certificate of financial responsibility in lieu of an insurance card.

Factors Influencing Car Insurance Premiums in Iowa

Getting a quote for cheap car insurance in Iowa requires some research and rate comparisons between different insurance companies, even though Iowa ranks near the bottom of national averages for car insurance costs. Some factors that impact insurance rates in Iowa include:

- Vehicle repair costs are generally less expensive in Iowa than elsewhere

- Overall accident fatality rates are slightly higher than national averages

- Auto insurance fraud is lower in Iowa than national averages

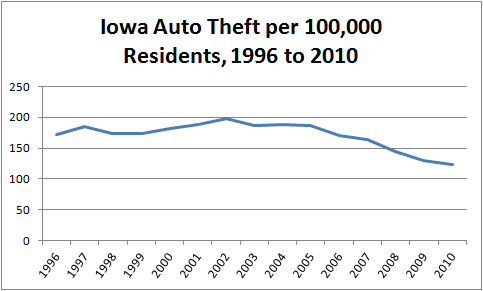

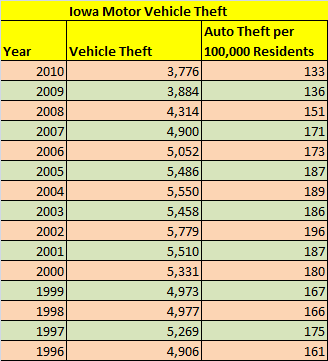

- Vehicle theft rates are below national averages

The average auto insurance premium for residents in Iowa is $532, making it #3 on the list of states with the lowest average car insurance costs.

Tips for Obtaining Cheap Car Insurance in Iowa

– If you’re over 50, and you take a defensive driving course, your insurance company is required by Iowa law to provide you with a 10% premium discount.

– Some insurance companies offer “pay as you drive” car insurance for low mileage drivers in Iowa

– As in any state, a history of safe driving — reflected in a clean driving record — is sure to reduce drivers’ premiums

– Look for insurance companies that offer discounts for combining homeowners, auto, and other insurance policies

– In Iowa, a good credit score will have a positive effect on car insurance costs

– Create a personal “emergency fund” of up to $1500 and increase deductibles accordingly

– Ask your insurance company for a list of all affinity discounts

– Don’t pay for collision or comprehensive coverage on older, paid-in-full vehicles

Iowa Statistics

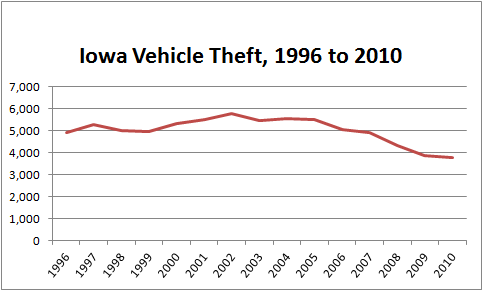

– Auto Theft: Iowa has historically had a relatively low vehicle theft rate, and it has been decreasing (as is the case in most states) consistently over the past 10 years. This can be attributed primarily to anti-theft devices being standard on recent model cars, as well as public awareness of the issue:

(Source: Iowa Department of Public Safety)

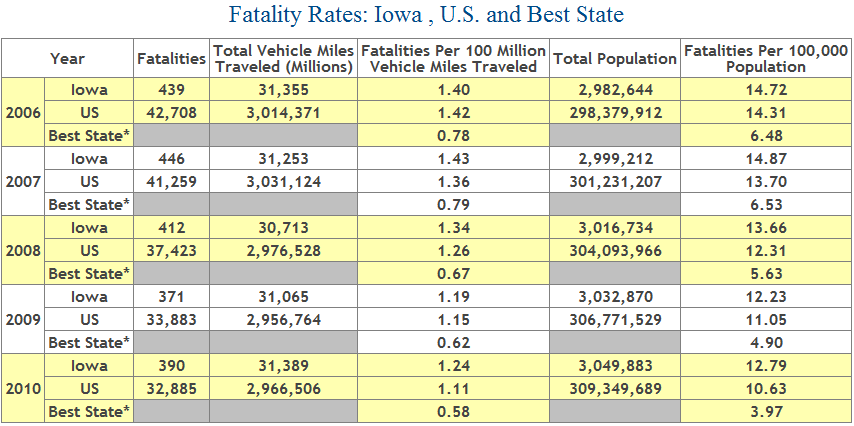

– Automobile Accidents: The total vehicle miles traveled in Iowa has remained relatively constant in recent years, but following a national trend, vehicle accident fatality rates have declined. Iowa is slightly above the national average in numbers of deaths in car crashes.

(Source: National Highway Traffic Safety Administration)

Enter your Zip Code below to find Cheap Car Insurance in Iowa.