Massachusetts Auto Insurance Requirements

Massachusetts Auto Insurance Requirements

Reviewed by Dr. Christine Berry

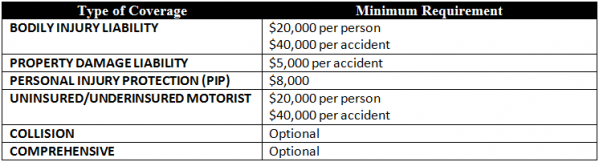

Massachusetts financial responsibility requirements are mandated by state law and the Massachusetts Division of Insurance. The following minimum coverage is required on every registered vehicle, except as noted below:

(Source: Massachusetts Office of the Attorney General)

Alternatively, drivers not wishing to carry basic liability insurance in Massachusetts may deposit cash or securities or execute a surety bond with the State Treasurer in an amount equal to mandatory liability coverage requirements, who will issue a certificate of financial responsibility in lieu of an insurance card.

Driving without meeting the financial responsibility requirements in Massachusetts could result in a fine anywhere from $500 to $5,000 and suspension of the drivers license and motor vehicle registration.

The Massachusetts Automobile Insurance Plan is available to drivers who are unable to obtain required coverage through the voluntary market. More information is available on the Massachusetts Consumer Affairs website.

Factors Influencing Car Insurance Premiums in Massachusetts

Getting a quote for cheap car insurance in Massachusetts requires some research and rate comparisons between different insurance companies, even though Massachusetts ranks below national averages for car insurance costs. Some factors that impact insurance rates in Massachusetts include:

– Location – insurance rates are much cheaper in the Western part of the state, rather than the heavily populated eastern half of the state

– Vehicle repair costs are generally more expensive in Massachusetts than elsewhere

– Overall accident fatality rates in Michigan are the lowest in the nation

– A higher percentage of uninsured drivers compared to national averages

The average auto insurance premium for residents in Massachusetts is $860, making Massachusetts the 13th-most expensive state for car insurance.

Tips for Obtaining Cheap Car Insurance in Massachusetts

– If you’re over 55, take a state-approved defensive driving course for a policy discount

Take advantage of Massachusetts’excellent mass transit system for daily commuters as some insurance companies offer discounts for low mileage or “pay as you drive” insurance

– Since it is now against the law in Massachusetts to text and drive, if you receive a ticket for texting while driving, your auto insurance rates will likely go up

– Maintain a good driving record

– Ask about discounts for college graduates and good students

– Bind multiple policies (homeowners, life, auto) with the same provider

– Create a personal “emergency fund” of up to $1500 and increase deductibles accordingly

– Discuss affinity discounts with your insurance provider

– Drop comprehensive and collision insurance on older vehicles that are paid off and are worth less than $1,000

In Massachusetts, the Safe Driver Insurance Plan (SDIP) sets the specific credits and surcharges that an insurance company may apply to your premium. You can find additional information on the SDIP and on ways to reduce your premium at the Massachusetts Department of Transportation’s website.

Some good news for Massachusetts drivers (sort of): Massachusetts is one of a handful of states that does not allow insurance companies to consider drivers’ credit scores when setting insurance premiums.

Massachusetts Statistics

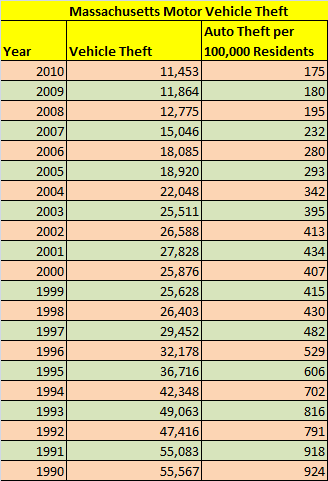

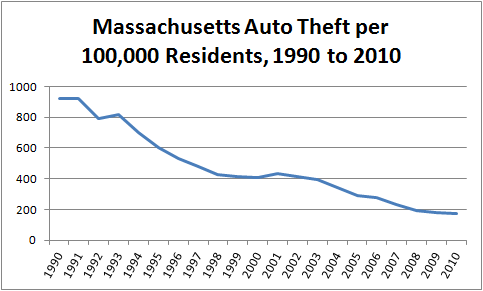

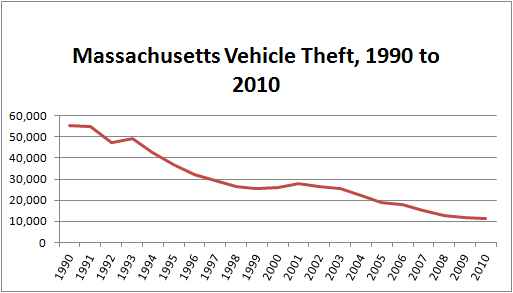

– Auto Theft: Massachusetts has a vehicle theft rate somewhat lower than national averages, and it has decreased significantly over the past 10 years. This can be attributed primarily to anti-theft devices being standard on recent model cars, as well as public awareness of the issue:

(Source: Massachusetts Office of Public Safety and Security)

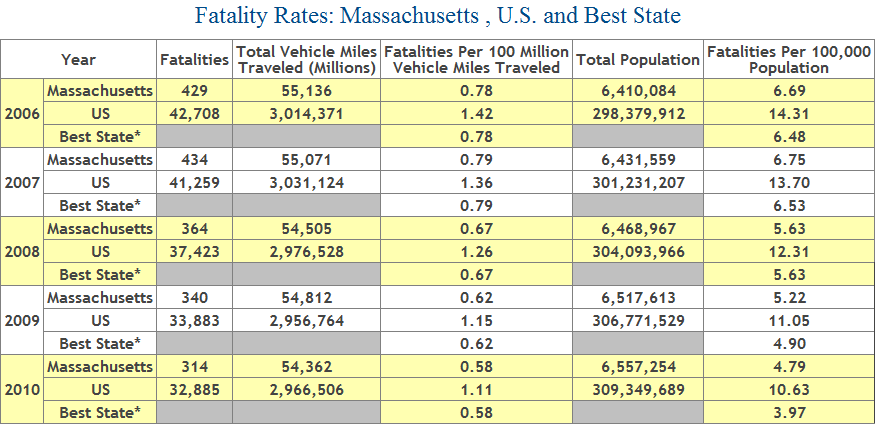

– Automobile Accidents: The total vehicle miles traveled in Massachusetts has remained consistent in recent years, and vehicle accident fatality rates have been the lowest in the nation for the past three years running despite having a fairly high population concentration.

(Source: National Highway Traffic Safety Administration)

Enter your Zip Code below to find Cheap Car Insurance in Massachusetts.