Every state in the U.S. has different rules and regulations when it comes to car insurance, so finding cheap car insurance is a different process in every state. These state-specific articles will provide you with information you need to get the best value for your car insurance in any state.

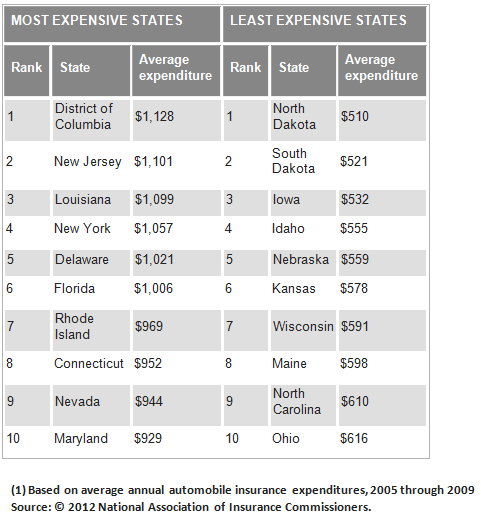

This list of the least and most expensive states for car insurance was compiled by the National Association of Insurance Commissioners (NAIC) and appears in at the Insurance Information Institute website:

TOP TEN MOST EXPENSIVE AND LEAST EXPENSIVE STATES FOR AUTOMOBILE INSURANCE(1)

Cheap car insurance is difficult to find in many areas. Not only do state-level requirements impact policy premiums, but so do local conditions. Many factors go into rating risk in individual states. The concept of cheap car insurance is relative. For example, some states (like Louisiana) have a high percentage of uninsured drivers, resulting in higher insurance rates for everyone. Other states, such as New Jersey and Michigan, are “no fault” insurance states that require drivers to carry personal injury protection insurance.

Whether you live in a state with high or low average auto insurance premiums, the only way to know whether you’re getting cheap car insurance is to shop around.

Regardless of where you live, there are certain steps that you can take to get a better deal on auto insurance at renewal time. Each of our state-level pages, linked below, has been customized to provide tips and information on getting best possible coverage for the least amount of money.

Getting cheap car insurance starts with knowledge on your part. As a consumer, understanding the factors that impact car insurance premiums in your state will help you get a better deal. If you’re getting ready to move to another state (or helping an out of state friend or family member research the best available rates), we give you the information that you need. Click on a state below to get started!