Let’s say it’s close to the time for renewing your car insurance policy, and you’re reviewing coverage with your agent. If you’ve recently paid off your auto loan, you might be tempted to drop optional coverage such as comprehensive or collision. When faced with such a decision, you need to ask yourself: are you being penny wise and pound foolish? Reducing your coverage to minimum auto liability coverage might be a mistake.

Let’s say it’s close to the time for renewing your car insurance policy, and you’re reviewing coverage with your agent. If you’ve recently paid off your auto loan, you might be tempted to drop optional coverage such as comprehensive or collision. When faced with such a decision, you need to ask yourself: are you being penny wise and pound foolish? Reducing your coverage to minimum auto liability coverage might be a mistake.

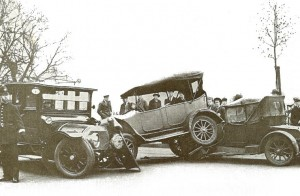

Even if you’ve paid off your car, it’s likely to have significant value if it is a fairly late model car. Think about the cost of repairing or replacing the vehicle if you’re at fault in an accident, and the other party’s insurance company won’t cover the damage to your car. Or, maybe you hit a patch of ice on a cold winter morning, and skid into a guardrail. Either way, if you only have minimum auto liability coverage, the cost of repairing / replacing your car is going to come out of your pocket.

Calculating the Cost

The general rule of thumb for dropping comprehensive and collision insurance options is that if your car is worth more than ten times the cost of the coverage, you need it. In other words, if you’re paying $600 / year for these options, and the book value of your car is worth more than $6,000, you should retain the coverage.

Even if your car is worth less than ten times the cost of the coverage, if you total it, are you going to be able to buy an equivalent car from your savings?

Protecting Your Family’s Financial Future

Minimum auto liability coverage is about more than just not having the comprehensive and collision options. In most states, you are required by law to carry bodily injury ($10,000 to $20,000), property damage ($15,000 to $25,000), and in some cases personal injury protection (PIP). These minimum coverages are designed to give another party else at least a bit of payout if you’re at fault in an accident. But in the real world, this minimum auto liability coverage is rarely enough to cover the costs of a serious accident. Where do additional payouts come from? You, when the other party takes you to court.

In our litigious society, minimum auto liability coverage is rarely enough if you own a house or have any significant personal assets. So, it’s important to consider your own personal financial risk when making a decision about where to set the level of your coverage. Talk to your agent, or even your personal financial advisor. One bad accident can have a lifetime of impact on your finances.